Continued Market Weakness: Will Low Prices Solve the Problem?

There has been no let-up in the recent weakening in European and World dairy markets. Last week’s GDT auction featured another 6% drop in the Trade Wighted Index. This represents a 44.5% drop in the index since February 14th event. In Irish milk price terms, that would equate to 20c per litre, or intervention price. Meanwhile, the Eurex Index suggests a butter price of €3023, or 36% above the Intervention buying-in price of €2217.51, and an SMP price of €2117, or 21% above the Intervention price of €1746.90.

The current Eurex quotes suggest a milk value of 25-26c per litre, for Irish constituents. At last week’s European Commission Civil Dialogue Meeting, with Dairy Stakeholders, which the author attended, Dairy Companies, Co-ops and farmers from Eastern countries, most affected by the Russian ban, reported milk prices of 21-24c per litre. Even Germany, which is less affected by the current ban, having already been frozen out of the Russian market for “technical” reasons, reports that the current price of 37c per Kg is expected to drop to 30c by December.

On the positive side, traders report some uptake in buyer behavious, with the expectation that the current low price levels may be prompting buyers into the market, to take some cover. Heretofore, buyers were only willing to buy to cover their short term requirements.

The Commission are keen to emphasise that the Russian ban only affects 1.5% of European production, however, in 2013, Russia accounted for 33% of EU cheese exports and 28% of butter exports. This explains their belief that that the proposed support measures, i.e. storage aid for butter, SMP and some cheese, ought to give a strong enough signal to the markets that surplus product (including the 250,000t of cheese locked out of Russia) will not be hanging around the marketplace.

The European Dairy trade, however, have concerns regarding the operation of the PSA scheme, citing a worry that the stored product, which can be put in store between now and the end of the year, for between 90 and 210 days (of between 60 and 210 days, for cheese), will be coming out of store in the spring or early summer, just in time to meet next year’s post quota supply surge. They also suggest that the storage aid rates are not attractive, particularly in the context of an expected surge in demand for storage facilities to cope with all the range of embargoed products. The rates are as follows: Butter fixed €18.93 /t plus 28c a day, SMP fixed €8.86 /t plus 16c a day and Cheeses fixed €15.57 /t plus .40c a day.

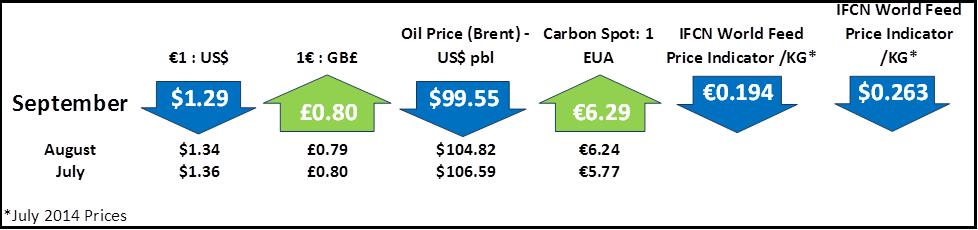

While the Russian ban is having catastrophic effects on dairy suppliers and processors in countries with a high level of exposure to the Russian market, and the displaced product is having a knock-on effect on other markets, the key factor affecting current market weakness is the 4.5-5% increase in global milk supply this year, against a demand growth of 2.5%, resulting in a glut of product equivalent to over 15m tonnes of milk. That’s almost all of New Zealand’s exports. The only thing that can rectify that imbalance is price; lower prices may encourage farmers to reduce supply (but by how much with record low feed prices?), and those same low prices may promote consumption, particularly in developing countries which were frozen out of the market by previously record high prices.